The “Loss Chase”: Why You Double Down When You Should Walk Away

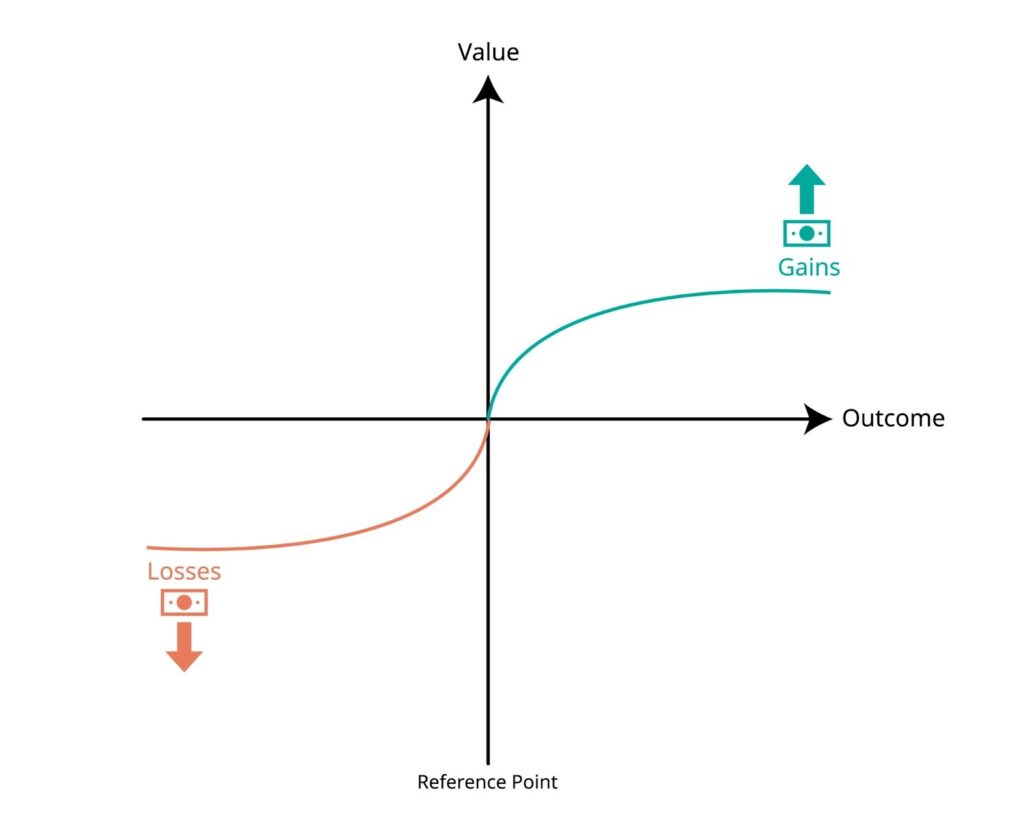

Whether it’s losing $500 on crypto, losing a ranked match in League of Legends, or wasting 3 hours on TikTok, the brain’s reaction is the same: “I need to fix this NOW.” This is “Loss Chasing.” It is driven by “Loss Aversion”—the biological fact that losing hurts twice as much as winning feels good. When you chase, your IQ drops and your emotions take the wheel. The only way to stop? An Accountability Partner that acts as your “Rational Brain” when yours has gone offline.

Getty Images

Explore

It starts with a small loss. You bet $50 and lose. You lose one game of Valorant. You waste 30 minutes scrolling when you should have been working.

A rational brain would say: “Okay, bad luck. Cut your losses. Walk away.” But an addicted brain says: “I can’t end on a loss. I need to get back to even.”

So you bet $100. You queue up for another match (playing angry). You scroll harder, looking for the one video that makes the time waste “worth it.”

This is the Loss Chase. In financial circles, it leads to bankruptcy. In gaming, it leads to “Tilt” and broken keyboards. In digital addiction, it leads to “Revenge Bedtime Procrastination”—staying up until 4 AM trying to “win back” the free time you wasted during the day.

Key Takeaways: The Mathematics of Tilt

- Loss Aversion: Psychologists Daniel Kahneman and Amos Tversky proved that the pain of losing $100 is 2x more intense than the joy of winning $100. We will do irrational things to avoid that pain.

- The Gambler’s Fallacy: The mistaken belief that if something happens frequently (losing), the opposite (winning) is “due” to happen soon. “I’ve lost 5 times in a row; the next one HAS to be a win.” (Spoiler: It doesn’t).

- Financial PTSD: Chronic loss chasing rewires the brain to associate “High Stress” with “Action,” leading to a state where you only feel alive when you are risking everything.

- The Accountability Mirror: You cannot see the fallacy when you are inside it. You need a mirror.

The Neuroscience of “Getting Even”

Why is walking away so hard? Because to your brain, accepting a loss feels like death.

When you lose, your Amgydala (Threat Detection) fires. It screams that you are “resource poor” and in danger. Simultaneously, your Prefrontal Cortex (Logic) is flooded with cortisol. It shuts down.

You enter a state called “Hot Cognition.” In this state, you are literally incapable of calculating odds correctly. You overestimate your skill and underestimate the risk. You are not thinking; you are reacting.

This is why “Revenge Trading” (in crypto) or “Rage Queuing” (in gaming) is so destructive. You are playing blindly, fueled by a desperate need to make the bad feeling go away.

The Gambler’s Fallacy: “I’m Due for a Win”

The engine of the Loss Chase is a cognitive glitch called the Gambler’s Fallacy. You believe the universe keeps a scorecard. You believe that “Law of Averages” means a win is inevitable.

- The Reality: The coin has no memory. The slot machine has no memory. The matchmaking algorithm doesn’t care if you lost 10 times. The odds are always 50/50 (or worse).

The addiction isn’t to the winning; it’s to the hope that the next spin fixes everything.

How Accountably Breaks the Chase

You cannot reason with Hot Cognition. You cannot “willpower” your way out of a Tilt. You need an external anchor.

Most “blockers” just lock you out. This often causes you to smash your phone or find a workaround because the urge to win back the loss is still there. Accountably takes a different approach: Cognitive Mirroring.

1. The Reality Check (Pattern Recognition)

Our Digital Phenotyping detects the “Chase Signature”—rapid bets, back-to-back gaming matches without breaks, or frantic app switching late at night. The AI intervenes with a “Socratic” reality check:

- AI: “I notice you’ve queued for 3 matches in a row after losses. Your typing speed suggests you are frustrated. Are you playing to have fun, or are you playing to fix the loss?”

2. Breaking the “Tunnel Vision”

When you are chasing, you have tunnel vision. You can only see the game/trade. The AI forces you to widen your lens.

- AI: “The math says the coin has no memory. Playing angry usually leads to more losses. What if we took a 15-minute reset? The game will be there when you get back.” It doesn’t force you; it reminds you of the logic you currently can’t access.

3. The “Cool Down” (Holding Space)

Sometimes, you just need someone to sit with you in the discomfort of the loss. Instead of letting you bet again to numb the pain, the AI acts as a sounding board.

- AI: “It sucks to lose that progress. I get it. But betting double now is the Gambler’s Fallacy talking. Let’s sit with this feeling for 2 minutes. It will pass.”

Stop Digging

There is an old adage: “When you find yourself in a hole, stop digging.” But when you are panicked, the shovel feels like the only tool you have.

You need a partner standing at the top of the hole, reminding you that there is a ladder. Don’t chase the loss. Chase the freedom.

(Let’s stop the spiral before it starts.)

FAQ: Breaking the Tilt

Q: Why do I get angrier when I lose at video games than sports? A: Algorithms. Video games and gambling apps are designed with Variable Reward Schedules and instant replay loops that keep you in a “Hot State.” Physical sports have natural breaks that allow cortisol to dissipate.

Q: How do I know if I’m “Tilting”? A: Look at your mechanics. Are you clicking harder? Is your posture tight? Are you making high-risk, low-probability plays? If your physical tension is high, your IQ is low. You are tilting.Q: What is the “Stop-Loss” rule?A: A rule borrowed from day trading. Set a hard rule: “If I lose 2 games in a row (or $X), I must walk away for 30 minutes.” No exceptions. Accountably can help enforce this digital boundary.